2023 Chinese EV Market and Chinese OEMs[1] Overseas Market Targeting Trend[2]

From

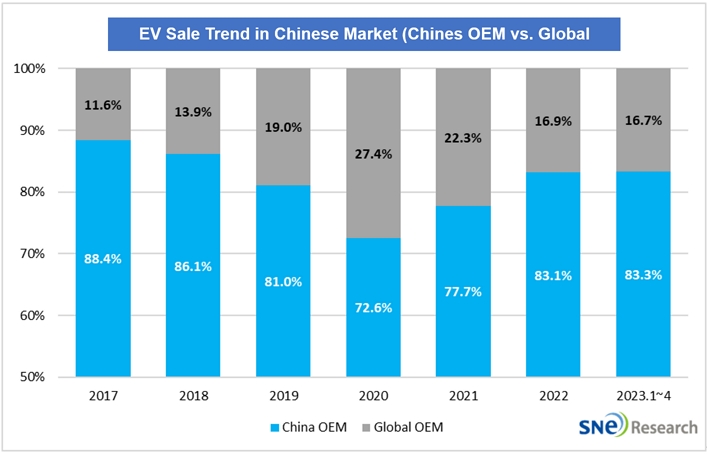

Jan to Apr 2023, a total number of electric vehicles (BEV+PHEV) registered in

the world was approximately 3.723 million units, recording a 40.1% YoY

increase. Among the global EV sale, those sold in China were 2.126 million

units, taking up 57.1% of the market share.

(Source: Global Monthly EV and Battery Monthly Tracker published in May 2023, SNE Research)

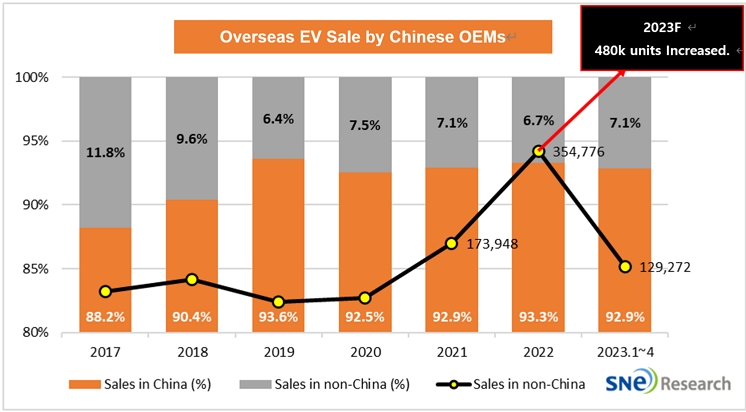

The overseas

electric vehicle sale by the Chinese OEMs had declined till 2019, but after

that the portion has sustained at around 7%. On the other hand, the number of

electric vehicles sold has seen a 81% YoY increase since 2019, accelerating the

entrance to overseas markets by the Chinese OEMs. Particularly, several Chinese

OEMs have already started to aggressively sell their EV models in the European

and Asian regions including Atto3 from BYD, MG from SAIC, and Lynk & Co

from Geely. From Jan to Apr 2023, a total of 130,000 units have been sold, and

more than 480,000 units are expected to be sold in 2023.

[2] Based on the number of electric vehicles of non-China OEMs and Chinese OEMs sold in different regions.